Struggling to Align Client Teams After the Deal? You’re Not Alone.

Up to 90% of M&A Deals Don’t Deliver – Weak Relationship Visibility Is to Blame.

Many post M&A integrations fail – not because of poor strategy, but due to fragmented client data. This guide shows how to simplify post M&A integration by protecting client relationships and aligning teams around client insights from the outset.

When no one knows who owns the client relationship, deals unravel fast. Outreach gets duplicated. Clients feel ignored. And cross-firm collaboration stalls before it starts. Without full visibility into key connections, even the strongest M&A strategy can fall apart post-close.

What this guide delivers

Map and connect client relationships across merging firms, before and after Day One

Avoid redundant outreach and align teams for seamless transition

Auto-enrich contact and CRM data with zero manual cleanup required

Ready to see what effective post M&A integration looks like in action?

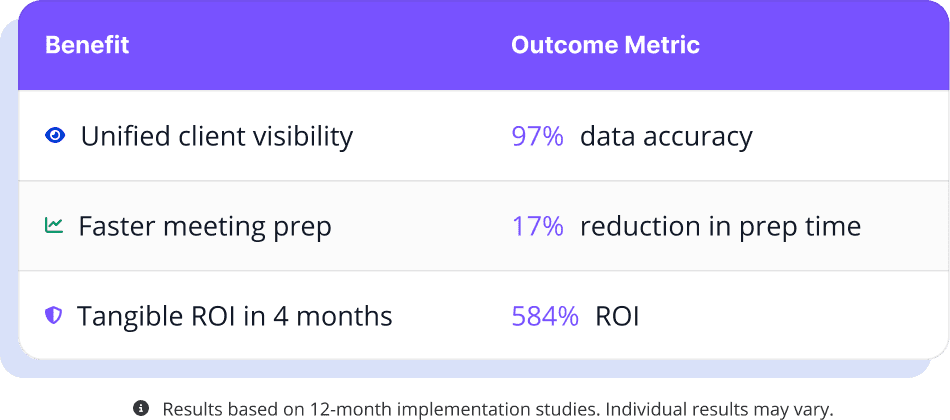

What firms are seeing with Introhive

What our customers say

Harbour

– Beth Moore, Chief Marketing Officer

Learn more

Blue & Co LLP

– Chief Growth Officer, Blue & Co LLP

Read the Blog →

Learn more

Read the Blog →

Learn more →

SOC 2 Compliant | GDPR Ready | Trusted by 200+ Professional Services Firms

Only 10 Strategic Account Audits Per Month

We limit audits to offer personalized support for firms serious about integration success.

“The return has been remarkable.”

See how professional services leaders are applying customer intelligence to their digital transformation strategies to unlock growth, while strengthening client relationships during uncertain economic times.

“Implementing Introhive was one of the simplest we’ve come across.”

“It almost seemed too good to be true.”

“We now have a 97% data accuracy rate for our CRM systems which is pretty unique.”

“It’s up to date, it’s timely, it’s clean, it’s correct, it’s frictionless and it doesn’t require the fee earners or the admin support to put any manual effort into the process.”

“It’s far easier to sell to someone where you have a warm relationship versus a cold one. The insights we get from Introhive add real value to our firm.”

Frequently asked questions

How does effective post M&A integration impact client growth and retention?

It protects key relationships from getting lost in the shuffle. With relationship intelligence, firms can unify client data across merging entities, avoid duplicated outreach, and preserve institutional knowledge, ensuring continuity and long-term revenue growth from day one.

How does relationship intelligence accelerate value creation after a merger?

By mapping who knows whom (and how well), teams can prioritize cross-sell opportunities, align on outreach, and activate warm connections instantly. This transforms scattered client data into a strategic growth asset.

What’s the biggest risk during post-merger integration?

The biggest risk firms face is client attrition caused by fragmented data. Without relationship visibility, outreach gets messy, trust erodes, and growth stalls. Relationship intelligence helps prevent this by keeping connections intact and collaboration seamless.