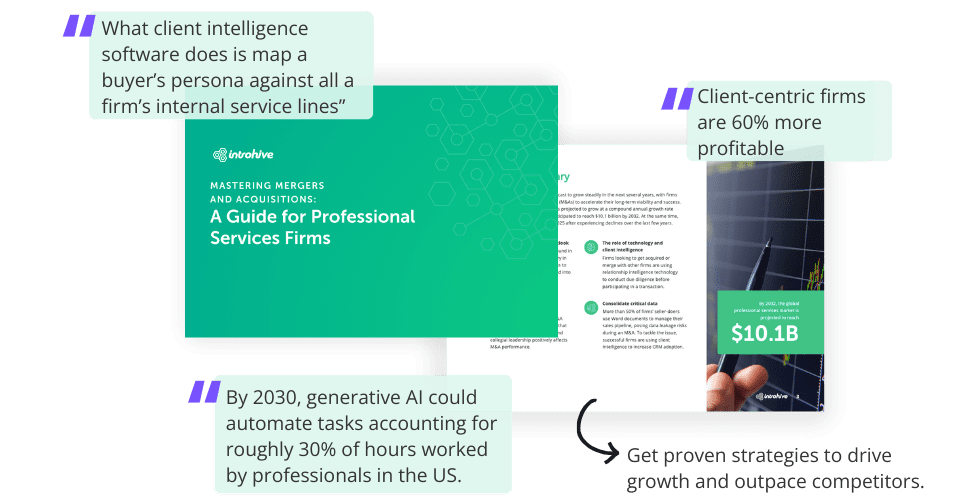

Maximizing Success in Mergers and Acquisitions: A Guide

Discover the critical strategies top firms are using to navigate the complexities of mergers and acquisitions (M&As). Read this exclusive FREE guide to learn how to ensure collaboration, foster client loyalty, and drive value post merger.

[{"id":47569,"link":"https:\/\/www.introhive.com\/blog\/laing-orourke-and-introhive\/","name":"laing-orourke-and-introhive","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/07\/Laing-ORourke-and-Introhive.jpg","alt":""},"title":"Building Trust Before Buildings: How Laing O\u2019Rourke Transformed Client Engagement with Salesforce and Introhive","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Jul 10, 2025","dateGMT":"2025-07-10 20:57:38","modifiedDate":"2025-07-10 16:57:39","modifiedDateGMT":"2025-07-10 20:57:39","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"","blog-tag":""},"readTime":{"min":7,"sec":42},"status":"publish","content":"Laing O\u2019Rourke and Introhive Laing O\u2019Rourke\u2019s journey with Introhive began as part of a broader CRM transformation, led in partnership with Credera"},{"id":46664,"link":"https:\/\/www.introhive.com\/blog\/optimising-legal-crm-systems\/","name":"optimising-legal-crm-systems","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/legal-crm-systems.jpg","alt":"Legal professional seamlessly using CRM data in his day-to-day workflow, highlighting the practical benefits of legal CRM systems for law firms once common challenges are overcome."},"title":"Beyond a Database: Making CRM Work for Law Firm Growth","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 29, 2025","dateGMT":"2025-05-29 14:04:14","modifiedDate":"2025-05-29 10:09:46","modifiedDateGMT":"2025-05-29 14:09:46","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/crm-data-automation\/' rel='blog-category'>CRM Data Automation<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/customer-relationship-management-crm\/' rel='blog-category'>Customer Relationship Management (CRM)<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/crm-automation\/' rel='blog-tag'>crm automation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-challenges\/' rel='blog-tag'>CRM Challenges<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-data\/' rel='blog-tag'>CRM Data<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-data-automation\/' rel='blog-tag'>CRM data automation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal\/' rel='blog-tag'>legal<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-firms\/' rel='blog-tag'>legal firms<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-industry\/' rel='blog-tag'>legal industry<\/a>"},"readTime":{"min":8,"sec":8},"status":"publish","content":"For many law firms, legal CRM systems promise growth, stronger customer relationships, and smarter business development. Yet despite these ambitions, many still"},{"id":46156,"link":"https:\/\/www.introhive.com\/blog\/digital-business-transformation-strategy\/","name":"digital-business-transformation-strategy","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/Digital-business-transformation-strategy.jpg","alt":"Team celebrating successful digital business transformation strategy with high-fives and applause in a modern office meeting."},"title":"What\u2019s Driving Growth in 2025? 4 Takeaways from a Fireside Chat with Professional Services Leaders","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 6, 2025","dateGMT":"2025-05-06 13:00:56","modifiedDate":"2025-05-07 12:50:49","modifiedDateGMT":"2025-05-07 16:50:49","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/digital-transformation\/' rel='blog-category'>Digital Transformation<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/revenue-acceleration\/' rel='blog-category'>Revenue Acceleration<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm-business-development\/' rel='blog-tag'>Accounting Firm Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/growing-revenue\/' rel='blog-tag'>Growing revenue<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/professional-services\/' rel='blog-tag'>professional services<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/revenue-growth\/' rel='blog-tag'>Revenue growth<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","content":"As professional services firms continue to navigate 2025, growth is back on the table following the capacity challenges many firms faced last"},{"id":46073,"link":"https:\/\/www.introhive.com\/blog\/social-capital-and-ai\/","name":"social-capital-and-ai","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/social-capital.jpg","alt":"Two professional women building social capital through a friendly business conversation in a modern office lounge."},"title":"How Relationships Supercharge Women\u2019s Careers in the Age of AI","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 1, 2025","dateGMT":"2025-05-01 13:16:20","modifiedDate":"2025-05-23 12:54:15","modifiedDateGMT":"2025-05-23 16:54:15","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/artificial-intelligence\/' rel='blog-category'>Artificial Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/customer-intelligence\/' rel='blog-category'>Customer Intelligence<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/introhive-news\/' rel='blog-tag'>introhive news<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/social-capital-theory\/' rel='blog-tag'>Social Capital Theory<\/a>"},"readTime":{"min":6,"sec":29},"status":"publish","content":"Introhive\u2019s Chief Financial Officer, Saeideh Fard, will be speaking at the upcoming Women in Tech Global Conference on how relationships continue to"},{"id":45990,"link":"https:\/\/www.introhive.com\/blog\/digital-transformation-in-accounting-contact-management\/","name":"digital-transformation-in-accounting-contact-management","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/digital-transformation-in-accounting-2.jpg","alt":"Professionals networking at a business event, representing contact management as a key stage in the digital transformation journey in accounting."},"title":"How Accounting Firms Can Enhance Contact Management Without a CRM","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 15, 2025","dateGMT":"2025-04-15 13:00:00","modifiedDate":"2025-05-02 14:24:53","modifiedDateGMT":"2025-05-02 18:24:53","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting\/' rel='blog-tag'>accounting<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-business-development\/' rel='blog-tag'>Accounting Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm\/' rel='blog-tag'>Accounting Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm-business-development\/' rel='blog-tag'>Accounting Firm Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/client-relationship-management\/' rel='blog-tag'>Client Relationship Management<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/enterprise-relationship-managment\/' rel='blog-tag'>enterprise relationship managment<\/a>"},"readTime":{"min":8,"sec":46},"status":"publish","content":"Managing contact data in accounting and advisory firms is overwhelming when it's scattered across spreadsheets, notes, business cards, email chains, and platforms"},{"id":45850,"link":"https:\/\/www.introhive.com\/blog\/crm-for-law-firms\/","name":"crm-for-law-firms","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/CRM-for-law-firms.jpg","alt":"Team members at a law firm meeting to assess how different technology solutions and CRM for law firms can support evolving client relationship strategies and modern technology needs."},"title":"Overcoming Technology Overload: How To Know What's Right for Your Firm","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 8, 2025","dateGMT":"2025-04-08 13:00:00","modifiedDate":"2025-04-08 09:01:46","modifiedDateGMT":"2025-04-08 13:01:46","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/customer-relationship-management-crm\/' rel='blog-category'>Customer Relationship Management (CRM)<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/how-to-choose-a-crm-for-your-law-firm\/' rel='blog-tag'>how to choose a CRM for your law firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/law\/' rel='blog-tag'>law<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/law-firm\/' rel='blog-tag'>Law Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal\/' rel='blog-tag'>legal<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-firms\/' rel='blog-tag'>legal firms<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-industry\/' rel='blog-tag'>legal industry<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-marketing-innovation\/' rel='blog-tag'>legal marketing innovation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/marketing-technology\/' rel='blog-tag'>Marketing Technology<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/sales-technology\/' rel='blog-tag'>sales technology<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/technology\/' rel='blog-tag'>technology<\/a>"},"readTime":{"min":6,"sec":4},"status":"publish","content":"In our latest exclusive Q&A, we speak with Daniela Guarna, Legal Account Executive at Introhive about the evolving role of CRM for"},{"id":45781,"link":"https:\/\/www.introhive.com\/blog\/accounting-ma-due-diligence\/","name":"accounting-ma-due-diligence","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/accounting-MA-2.jpg","alt":"Diverse team of professionals discussing financial documents during an accounting M&A due diligence meeting in a modern office setting."},"title":"Why M&A Between Accounting Firms Requires a Data-Driven View of Client Relationships","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 1, 2025","dateGMT":"2025-04-01 13:00:00","modifiedDate":"2025-03-31 17:22:48","modifiedDateGMT":"2025-03-31 21:22:48","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting\/' rel='blog-tag'>accounting<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm\/' rel='blog-tag'>Accounting Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/merger-and-acquisition\/' rel='blog-tag'>merger and acquisition<\/a>"},"readTime":{"min":5,"sec":3},"status":"publish","content":"Mergers and acquisitions among accounting firms continues its strong momentum, with firms increasingly focused on expanding their services, strengthening market presence, and"},{"id":45746,"link":"https:\/\/www.introhive.com\/blog\/introhive-for-lateral-hiring\/","name":"introhive-for-lateral-hiring","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/Introhive-for-lateral-hiring.jpg","alt":"Colleagues at a professional services firm sharing a laugh in a modern office setting, reflecting the collaborative culture fostered by Introhive for lateral hiring."},"title":"How Introhive Drives Lateral Hiring Success Through Data-Driven Collaboration","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Mar 25, 2025","dateGMT":"2025-03-25 13:00:00","modifiedDate":"2025-04-14 17:32:13","modifiedDateGMT":"2025-04-14 21:32:13","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/collaboration\/' rel='blog-tag'>Collaboration<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/growing-revenue\/' rel='blog-tag'>Growing revenue<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/revenue-growth\/' rel='blog-tag'>Revenue growth<\/a>"},"readTime":{"min":6,"sec":4},"status":"publish","content":"Lateral hiring is a massive investment for professional services firms and carries with it the expectation that new hires will expand business"},{"id":45743,"link":"https:\/\/www.introhive.com\/blog\/the-future-of-data-privacy-and-security\/","name":"the-future-of-data-privacy-and-security","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/data-privacy-and-security.jpg","alt":"Three business professionals collaborating in a modern office, reviewing data on a computer screen. Their discussion highlights the importance of data privacy and security in workplace operations, ensuring compliance with evolving regulations."},"title":"AI, Compliance, and the Evolving Risk Landscape: What Firms Need to Know","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Mar 18, 2025","dateGMT":"2025-03-18 13:00:00","modifiedDate":"2025-03-17 17:59:51","modifiedDateGMT":"2025-03-17 21:59:51","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/artificial-intelligence\/' rel='blog-category'>Artificial Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/data-privacy\/' rel='blog-category'>Data Privacy<\/a>","blog-tag":""},"readTime":{"min":8,"sec":8},"status":"publish","content":"In this exclusive Q&A, Introhive\u2019s Director of Risk and Compliance, Evan English shares his insights on the biggest data privacy and security"}]

[{"id":47569,"link":"https:\/\/www.introhive.com\/blog\/laing-orourke-and-introhive\/","name":"laing-orourke-and-introhive","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/07\/Laing-ORourke-and-Introhive.jpg","alt":""},"title":"Building Trust Before Buildings: How Laing O\u2019Rourke Transformed Client Engagement with Salesforce and Introhive","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Jul 10, 2025","dateGMT":"2025-07-10 20:57:38","modifiedDate":"2025-07-10 16:57:39","modifiedDateGMT":"2025-07-10 20:57:39","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"","blog-tag":""},"readTime":{"min":7,"sec":42},"status":"publish","excerpt":""},{"id":46664,"link":"https:\/\/www.introhive.com\/blog\/optimising-legal-crm-systems\/","name":"optimising-legal-crm-systems","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/legal-crm-systems.jpg","alt":"Legal professional seamlessly using CRM data in his day-to-day workflow, highlighting the practical benefits of legal CRM systems for law firms once common challenges are overcome."},"title":"Beyond a Database: Making CRM Work for Law Firm Growth","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 29, 2025","dateGMT":"2025-05-29 14:04:14","modifiedDate":"2025-05-29 10:09:46","modifiedDateGMT":"2025-05-29 14:09:46","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/crm-data-automation\/' rel='blog-category'>CRM Data Automation<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/customer-relationship-management-crm\/' rel='blog-category'>Customer Relationship Management (CRM)<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/crm-automation\/' rel='blog-tag'>crm automation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-challenges\/' rel='blog-tag'>CRM Challenges<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-data\/' rel='blog-tag'>CRM Data<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/crm-data-automation\/' rel='blog-tag'>CRM data automation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal\/' rel='blog-tag'>legal<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-firms\/' rel='blog-tag'>legal firms<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-industry\/' rel='blog-tag'>legal industry<\/a>"},"readTime":{"min":8,"sec":8},"status":"publish","excerpt":""},{"id":46156,"link":"https:\/\/www.introhive.com\/blog\/digital-business-transformation-strategy\/","name":"digital-business-transformation-strategy","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/Digital-business-transformation-strategy.jpg","alt":"Team celebrating successful digital business transformation strategy with high-fives and applause in a modern office meeting."},"title":"What\u2019s Driving Growth in 2025? 4 Takeaways from a Fireside Chat with Professional Services Leaders","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 6, 2025","dateGMT":"2025-05-06 13:00:56","modifiedDate":"2025-05-07 12:50:49","modifiedDateGMT":"2025-05-07 16:50:49","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/digital-transformation\/' rel='blog-category'>Digital Transformation<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/revenue-acceleration\/' rel='blog-category'>Revenue Acceleration<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm-business-development\/' rel='blog-tag'>Accounting Firm Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/growing-revenue\/' rel='blog-tag'>Growing revenue<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/professional-services\/' rel='blog-tag'>professional services<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/revenue-growth\/' rel='blog-tag'>Revenue growth<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","excerpt":""},{"id":46073,"link":"https:\/\/www.introhive.com\/blog\/social-capital-and-ai\/","name":"social-capital-and-ai","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/social-capital.jpg","alt":"Two professional women building social capital through a friendly business conversation in a modern office lounge."},"title":"How Relationships Supercharge Women\u2019s Careers in the Age of AI","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 1, 2025","dateGMT":"2025-05-01 13:16:20","modifiedDate":"2025-05-23 12:54:15","modifiedDateGMT":"2025-05-23 16:54:15","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/artificial-intelligence\/' rel='blog-category'>Artificial Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/customer-intelligence\/' rel='blog-category'>Customer Intelligence<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/introhive-news\/' rel='blog-tag'>introhive news<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/social-capital-theory\/' rel='blog-tag'>Social Capital Theory<\/a>"},"readTime":{"min":6,"sec":29},"status":"publish","excerpt":""},{"id":45990,"link":"https:\/\/www.introhive.com\/blog\/digital-transformation-in-accounting-contact-management\/","name":"digital-transformation-in-accounting-contact-management","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/digital-transformation-in-accounting-2.jpg","alt":"Professionals networking at a business event, representing contact management as a key stage in the digital transformation journey in accounting."},"title":"How Accounting Firms Can Enhance Contact Management Without a CRM","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 15, 2025","dateGMT":"2025-04-15 13:00:00","modifiedDate":"2025-05-02 14:24:53","modifiedDateGMT":"2025-05-02 18:24:53","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting\/' rel='blog-tag'>accounting<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-business-development\/' rel='blog-tag'>Accounting Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm\/' rel='blog-tag'>Accounting Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm-business-development\/' rel='blog-tag'>Accounting Firm Business Development<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/client-relationship-management\/' rel='blog-tag'>Client Relationship Management<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/enterprise-relationship-managment\/' rel='blog-tag'>enterprise relationship managment<\/a>"},"readTime":{"min":8,"sec":46},"status":"publish","excerpt":""},{"id":45850,"link":"https:\/\/www.introhive.com\/blog\/crm-for-law-firms\/","name":"crm-for-law-firms","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/CRM-for-law-firms.jpg","alt":"Team members at a law firm meeting to assess how different technology solutions and CRM for law firms can support evolving client relationship strategies and modern technology needs."},"title":"Overcoming Technology Overload: How To Know What's Right for Your Firm","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 8, 2025","dateGMT":"2025-04-08 13:00:00","modifiedDate":"2025-04-08 09:01:46","modifiedDateGMT":"2025-04-08 13:01:46","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/customer-relationship-management-crm\/' rel='blog-category'>Customer Relationship Management (CRM)<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/how-to-choose-a-crm-for-your-law-firm\/' rel='blog-tag'>how to choose a CRM for your law firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/law\/' rel='blog-tag'>law<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/law-firm\/' rel='blog-tag'>Law Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal\/' rel='blog-tag'>legal<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-firms\/' rel='blog-tag'>legal firms<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-industry\/' rel='blog-tag'>legal industry<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/legal-marketing-innovation\/' rel='blog-tag'>legal marketing innovation<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/marketing-technology\/' rel='blog-tag'>Marketing Technology<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/sales-technology\/' rel='blog-tag'>sales technology<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/technology\/' rel='blog-tag'>technology<\/a>"},"readTime":{"min":6,"sec":4},"status":"publish","excerpt":""},{"id":45781,"link":"https:\/\/www.introhive.com\/blog\/accounting-ma-due-diligence\/","name":"accounting-ma-due-diligence","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/accounting-MA-2.jpg","alt":"Diverse team of professionals discussing financial documents during an accounting M&A due diligence meeting in a modern office setting."},"title":"Why M&A Between Accounting Firms Requires a Data-Driven View of Client Relationships","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 1, 2025","dateGMT":"2025-04-01 13:00:00","modifiedDate":"2025-03-31 17:22:48","modifiedDateGMT":"2025-03-31 21:22:48","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/accounting\/' rel='blog-tag'>accounting<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/accounting-firm\/' rel='blog-tag'>Accounting Firm<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/merger-and-acquisition\/' rel='blog-tag'>merger and acquisition<\/a>"},"readTime":{"min":5,"sec":3},"status":"publish","excerpt":""},{"id":45746,"link":"https:\/\/www.introhive.com\/blog\/introhive-for-lateral-hiring\/","name":"introhive-for-lateral-hiring","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/Introhive-for-lateral-hiring.jpg","alt":"Colleagues at a professional services firm sharing a laugh in a modern office setting, reflecting the collaborative culture fostered by Introhive for lateral hiring."},"title":"How Introhive Drives Lateral Hiring Success Through Data-Driven Collaboration","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Mar 25, 2025","dateGMT":"2025-03-25 13:00:00","modifiedDate":"2025-04-14 17:32:13","modifiedDateGMT":"2025-04-14 21:32:13","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/relationship-intelligence\/' rel='blog-category'>Relationship Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/technology\/' rel='blog-category'>Technology<\/a>","blog-tag":"<a href='https:\/\/www.introhive.com\/blog\/tag\/collaboration\/' rel='blog-tag'>Collaboration<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/growing-revenue\/' rel='blog-tag'>Growing revenue<\/a><a href='https:\/\/www.introhive.com\/blog\/tag\/revenue-growth\/' rel='blog-tag'>Revenue growth<\/a>"},"readTime":{"min":6,"sec":4},"status":"publish","excerpt":""},{"id":45743,"link":"https:\/\/www.introhive.com\/blog\/the-future-of-data-privacy-and-security\/","name":"the-future-of-data-privacy-and-security","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/data-privacy-and-security.jpg","alt":"Three business professionals collaborating in a modern office, reviewing data on a computer screen. Their discussion highlights the importance of data privacy and security in workplace operations, ensuring compliance with evolving regulations."},"title":"AI, Compliance, and the Evolving Risk Landscape: What Firms Need to Know","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Mar 18, 2025","dateGMT":"2025-03-18 13:00:00","modifiedDate":"2025-03-17 17:59:51","modifiedDateGMT":"2025-03-17 21:59:51","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"blog-category":"<a href='https:\/\/www.introhive.com\/blog\/category\/artificial-intelligence\/' rel='blog-category'>Artificial Intelligence<\/a><a href='https:\/\/www.introhive.com\/blog\/category\/data-privacy\/' rel='blog-category'>Data Privacy<\/a>","blog-tag":""},"readTime":{"min":8,"sec":8},"status":"publish","excerpt":""}]

[{"id":46390,"link":"https:\/\/www.introhive.com\/news\/introhive-joins-the-hubspot-app-marketplace\/","name":"introhive-joins-the-hubspot-app-marketplace","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/Introhive-Joins-HubSpot-App-Marketplace.jpg","alt":"Introhive Joins the HubSpot App Marketplace"},"title":"Introhive Joins the HubSpot App Marketplace","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 13, 2025","dateGMT":"2025-05-13 13:22:31","modifiedDate":"2025-05-13 09:22:32","modifiedDateGMT":"2025-05-13 13:22:32","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":2,"sec":5},"status":"publish","excerpt":""},{"id":45996,"link":"https:\/\/www.introhive.com\/news\/introhive-introduces-enhanced-contact-management-capabilities\/","name":"introhive-introduces-enhanced-contact-management-capabilities","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/Introhive-Enhanced-Contact-Management-Capabilities.jpg","alt":"Introhive Introduces Enhanced Contact Management Capabilities"},"title":"Introhive Introduces Enhanced Contact Management Capabilities","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Apr 16, 2025","dateGMT":"2025-04-16 18:25:09","modifiedDate":"2025-04-21 13:33:31","modifiedDateGMT":"2025-04-21 17:33:31","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":2,"sec":3},"status":"publish","excerpt":""},{"id":45749,"link":"https:\/\/www.introhive.com\/news\/introhive-appoints-joanna-trimble-as-chief-revenue-officer-to-drive-customer-centric-growth-and-market-expansion\/","name":"introhive-appoints-joanna-trimble-as-chief-revenue-officer-to-drive-customer-centric-growth-and-market-expansion","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/Joanna-Trimble-CRO.jpg","alt":"Introhive announces the appointment of Joanna Trimble to the newly created Chief Revenue Officer (CRO) executive role."},"title":"Introhive Appoints Joanna Trimble as Chief Revenue Officer to Drive Customer-Centric Growth and Market Expansion\u00a0\u00a0","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Mar 25, 2025","dateGMT":"2025-03-25 13:31:57","modifiedDate":"2025-04-07 13:27:13","modifiedDateGMT":"2025-04-07 17:27:13","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":3,"sec":15},"status":"publish","excerpt":""},{"id":45537,"link":"https:\/\/www.introhive.com\/news\/introhive-strengthens-focus-on-accounting-and-advisory-firms-with-key-hire-and-bdo-alliance-membership\/","name":"introhive-strengthens-focus-on-accounting-and-advisory-firms-with-key-hire-and-bdo-alliance-membership","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/02\/Adam-Klein-Head-of-Industry-Announcement.jpg","alt":"Introhive strengthens focus on accounting and advisory firms with key hire, Adam Klein and BDO Alliance membership"},"title":"Introhive Strengthens Focus on Accounting and Advisory Firms with Key Hire and BDO Alliance Membership","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Feb 4, 2025","dateGMT":"2025-02-04 14:03:26","modifiedDate":"2025-04-07 13:28:46","modifiedDateGMT":"2025-04-07 17:28:46","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":3,"sec":0},"status":"publish","excerpt":""},{"id":45519,"link":"https:\/\/www.introhive.com\/news\/introhive-previews-cutting-edge-innovations-ask-introhive-and-signals\/","name":"introhive-previews-cutting-edge-innovations-ask-introhive-and-signals","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/01\/Aks-Introhive-Signals.jpg?ver=1738181965","alt":"Introhive Previews Cutting Edge Innovations: Ask Introhive and Signals"},"title":"Introhive Previews Cutting Edge Innovations: Ask Introhive and Signals","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Jan 29, 2025","dateGMT":"2025-01-29 20:17:01","modifiedDate":"2025-04-07 13:29:07","modifiedDateGMT":"2025-04-07 17:29:07","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":3,"sec":40},"status":"publish","excerpt":""},{"id":45120,"link":"https:\/\/www.introhive.com\/news\/introhive-comparably-best-place-to-work\/","name":"introhive-comparably-best-place-to-work","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/12\/Comparably-Awards.jpg","alt":"Introhive awarded Best CEO and Best Company Culture by Comparably."},"title":"Introhive Recognized as a Comparably Best Place to Work in 2024: Earns Best Company Culture and Best CEO Awards","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Dec 17, 2024","dateGMT":"2024-12-17 14:47:47","modifiedDate":"2024-12-17 09:47:47","modifiedDateGMT":"2024-12-17 14:47:47","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":"<a href='https:\/\/www.introhive.com\/news\/category\/company-news\/' rel='news-category'>Company News<\/a>"},"readTime":{"min":1,"sec":15},"status":"publish","excerpt":""},{"id":42482,"link":"https:\/\/www.introhive.com\/news\/introhive-ai-account-summaries\/","name":"introhive-ai-account-summaries","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/10\/AI-Account-Summaries-Announcement-2.jpg","alt":"Introhive announces AI Account Summaries"},"title":"Introhive Unveils AI Account Summaries, Ushering in a New Era of Relationship Intelligence","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Oct 16, 2024","dateGMT":"2024-10-16 11:04:28","modifiedDate":"2024-12-03 12:00:26","modifiedDateGMT":"2024-12-03 17:00:26","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":3,"sec":27},"status":"publish","excerpt":""},{"id":40124,"link":"https:\/\/www.introhive.com\/news\/kpmg-firms-boost-relationship-capital\/","name":"kpmg-firms-boost-relationship-capital","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/08\/KPMG-Press-Release.jpg","alt":"Introhive has been selected by KPMG firms press release"},"title":"KPMG Firms Boost Relationship Capital with Introhive","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Sep 7, 2024","dateGMT":"2024-09-07 14:57:51","modifiedDate":"2024-10-04 02:43:32","modifiedDateGMT":"2024-10-04 06:43:32","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":""},"readTime":{"min":2,"sec":48},"status":"publish","excerpt":""},{"id":39070,"link":"https:\/\/www.introhive.com\/news\/introhive-appoints-leyla-samiee-as-new-chief-product-officer\/","name":"introhive-appoints-leyla-samiee-as-new-chief-product-officer","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/06\/Leyla-Samiee-CPO-Announcement.jpg","alt":"Introhive Announces Appointment of new Chief Product Officer, Leyla Samiee"},"title":"Introhive Announces Leyla Samiee as New Chief Product Officer","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Aug 27, 2024","dateGMT":"2024-08-27 20:36:31","modifiedDate":"2024-10-04 02:45:04","modifiedDateGMT":"2024-10-04 06:45:04","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"news-category":"<a href='https:\/\/www.introhive.com\/news\/category\/company-news\/' rel='news-category'>Company News<\/a>"},"readTime":{"min":2,"sec":54},"status":"publish","excerpt":""}]

[{"id":46060,"link":"https:\/\/www.introhive.com\/resource\/the-client-centric-firm-turning-relationships-into-growth\/","name":"the-client-centric-firm-turning-relationships-into-growth","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/LBMC-BDO-Alliance-Webinar-2.jpg","alt":"Webinar: The Client-Centric Firm: Turning Relationships into Growth"},"title":"The Client-Centric Firm: Turning Relationships into Growth","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 1, 2025","dateGMT":"2025-05-01 14:40:48","modifiedDate":"2025-05-28 10:19:09","modifiedDateGMT":"2025-05-28 14:19:09","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":34},"status":"publish","excerpt":""},{"id":44689,"link":"https:\/\/www.introhive.com\/resource\/navigating-the-crm-journey-strategies-to-drive-growth-and-efficiency-in-law-firms\/","name":"navigating-the-crm-journey-strategies-to-drive-growth-and-efficiency-in-law-firms","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/02\/Omnilex-Webinar-.png","alt":""},"title":"Navigating the CRM Journey: Strategies to Drive Growth and Efficiency in Law Firms","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"Feb 18, 2025","dateGMT":"2025-02-18 15:20:45","modifiedDate":"2025-05-27 15:24:27","modifiedDateGMT":"2025-05-27 19:24:27","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":39},"status":"publish","excerpt":""},{"id":41184,"link":"https:\/\/www.introhive.com\/resource\/smarter-cross-functional-collaboration\/","name":"smarter-cross-functional-collaboration","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/10\/unlocking-relationships-through-smarter-collaboration.png","alt":"On-demand webinar: Unlocking the power of relationships through smarter collaboration"},"title":"Unlocking the Power of Relationships through Smarter Collaboration","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"Oct 21, 2024","dateGMT":"2024-10-21 14:34:07","modifiedDate":"2025-05-13 17:53:49","modifiedDateGMT":"2025-05-13 21:53:49","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":5,"sec":43},"status":"publish","excerpt":""},{"id":38977,"link":"https:\/\/www.introhive.com\/resource\/customer-solutions-spotlight-series\/","name":"customer-solutions-spotlight-series","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/06\/Solutions-Spotlight-feature-image-612x408-1.jpg","alt":"Solutions-Spotlight"},"title":"Customer Solutions Spotlight Series 2024","author":{"name":"Pouneh Hanafi","link":"https:\/\/www.introhive.com\/author\/pouneh-hanafiintrohive-com\/"},"date":"Aug 10, 2024","dateGMT":"2024-08-10 14:32:42","modifiedDate":"2025-03-13 09:46:23","modifiedDateGMT":"2025-03-13 13:46:23","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":48},"status":"publish","excerpt":""},{"id":39061,"link":"https:\/\/www.introhive.com\/resource\/on-demand-webinar-succession-planning\/","name":"on-demand-webinar-succession-planning","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/08\/on-demand-webinar-succession-planning.png","alt":"Introhive's On-Demand Succession Planning Webinar hero"},"title":"Strategic Succession Planning: Ensuring Client Confidence and Leadership Continuity","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Aug 9, 2024","dateGMT":"2024-08-09 19:22:07","modifiedDate":"2025-05-13 17:55:27","modifiedDateGMT":"2025-05-13 21:55:27","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":2,"sec":41},"status":"publish","excerpt":"On-Demand Webinar\nWith delicate client relationships and entrenched \u201cmy client\u201d mindsets, organizations encounter a multitude of hurdles in transitioning key personnel. This webinar explores the intricacies of succession planning, including strategic imperatives, complexities of compensation policies, ongoing client satisfaction, and practical steps essential for seamless transitions."},{"id":38256,"link":"https:\/\/www.introhive.com\/resource\/smashing-silos-on-demand-webinar\/","name":"smashing-silos-on-demand-webinar","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/08\/on-demand-webinar-smashing-silos.png","alt":"Introhive's on-demand webinar: Smashing Silos with Client Relationship Data"},"title":"Smashing Silos: Revolutionizing Law Firm Dynamics with Shared Client Relationship Insights","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Aug 8, 2024","dateGMT":"2024-08-08 21:15:04","modifiedDate":"2025-05-13 17:57:33","modifiedDateGMT":"2025-05-13 21:57:33","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":42},"status":"publish","excerpt":"Alan Mercer, Legal Industry Director at Introhive, Mike Anastasiades, Director of Solutions at Hike2 and Jo Cooper, Head of Marketing & BD Operations at Simmons & Simmons discuss the advantages of shared client relationship insights. Learn how the implementation of effective tools and processes can enhance collaboration, guiding your firm toward a synchronized and tech-savvy future."},{"id":40022,"link":"https:\/\/www.introhive.com\/resource\/whats-the-buzz\/","name":"whats-the-buzz","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2023\/01\/Whats-the-buzz-about-introhive-1.jpg","alt":"Green what's the buzz about Introhive sign with hexagons"},"title":"What\u2019s The Buzz","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Aug 7, 2024","dateGMT":"2024-08-07 13:07:22","modifiedDate":"2024-10-25 03:06:36","modifiedDateGMT":"2024-10-25 07:06:36","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":5,"sec":51},"status":"publish","excerpt":"This buzz-worthy webinar series features existing Introhive customers who will answer your questions and share how customer intelligence is helping them find leads, win opportunities and grow and maintain their customer base."},{"id":39832,"link":"https:\/\/www.introhive.com\/resource\/on-demand-webinar-customer-intelligence\/","name":"on-demand-webinar-customer-intelligence","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2022\/10\/Customer-Intelligence-Webinar.jpg","alt":"purple customer intelligence ad"},"title":"Customer Intelligence for Revenue Growth","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 24, 2024","dateGMT":"2024-07-24 05:38:14","modifiedDate":"2024-09-02 06:26:13","modifiedDateGMT":"2024-09-02 10:26:13","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":4},"status":"publish","excerpt":"Customer Intelligence is about to change the game. Be part of this chapter."},{"id":39839,"link":"https:\/\/www.introhive.com\/resource\/london-client-summit-2025\/","name":"london-client-summit-2025","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2021\/07\/City-of-London-Financial-District.jpg","alt":"London Financial District"},"title":"London Client Summit 2025","author":{"name":"Pouneh Hanafi","link":"https:\/\/www.introhive.com\/author\/pouneh-hanafiintrohive-com\/"},"date":"Jul 22, 2024","dateGMT":"2024-07-22 11:47:26","modifiedDate":"2025-06-20 15:04:50","modifiedDateGMT":"2025-06-20 19:04:50","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/events\/' rel='resource-type'>Events<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/webinars\/' rel='resource-type'>Webinars<\/a>"},"readTime":{"min":1,"sec":58},"status":"publish","excerpt":""}]

[{"id":16832,"link":"https:\/\/www.introhive.com\/resource\/laing-orourke-case-study-introhive-salesforce\/","name":"laing-orourke-case-study-introhive-salesforce","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/07\/Resource-Featured-images-2.jpg","alt":"Laing O\u2019Rourke case study resource page"},"title":"Laing O'Rourke case study: Transforming Client Engagement with Salesforce and Introhive","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Jul 10, 2025","dateGMT":"2025-07-10 20:39:53","modifiedDate":"2025-07-10 16:39:53","modifiedDateGMT":"2025-07-10 20:39:53","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":50},"status":"publish","excerpt":""},{"id":45943,"link":"https:\/\/www.introhive.com\/resource\/kingsley-napley-introhive\/","name":"kingsley-napley-introhive","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/04\/Kingsley-Napley-Introhive.jpg","alt":"Kingsley Napley Video Testimonial of Introhive"},"title":"Kingsley Napley & Introhive","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"Apr 11, 2025","dateGMT":"2025-04-11 18:46:29","modifiedDate":"2025-05-21 15:40:32","modifiedDateGMT":"2025-05-21 19:40:32","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":48},"status":"publish","excerpt":""},{"id":39939,"link":"https:\/\/www.introhive.com\/resource\/colliers-international\/","name":"colliers-international","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2021\/07\/colliers-feature-image.png","alt":"Colliers International logo"},"title":"Colliers International in Canada maps 140k CRM relationships","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 25, 2024","dateGMT":"2024-07-25 12:23:16","modifiedDate":"2025-01-14 11:49:57","modifiedDateGMT":"2025-01-14 16:49:57","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":32},"status":"publish","excerpt":"How Introhive helped Commercial Real Estate Firm Colliers International in Canada generates 300% more relationships in Microsoft Dynamics across the firms\u2019 500+ brokers using relationship intelligence and CRM automation platform"},{"id":39938,"link":"https:\/\/www.introhive.com\/resource\/frazier-deeter\/","name":"frazier-deeter","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2021\/06\/18.png","alt":"Frazier and Deeter Logo"},"title":"Frazier & Deeter: Automate Growth & Eliminate Manual Entry","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 25, 2024","dateGMT":"2024-07-25 12:04:44","modifiedDate":"2025-01-14 11:50:05","modifiedDateGMT":"2025-01-14 16:50:05","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":45},"status":"publish","excerpt":"How accounting firm Frazier & Deeter enhanced their marketing processes and impact with Introhive while"},{"id":39898,"link":"https:\/\/www.introhive.com\/resource\/lbmc\/","name":"lbmc","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2021\/07\/lbmc-feature-image.png","alt":"LBMC logo"},"title":"LBMC: 567% ROI in Time Savings & Customer Experience","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 24, 2024","dateGMT":"2024-07-24 07:53:34","modifiedDate":"2025-02-19 14:44:00","modifiedDateGMT":"2025-02-19 19:44:00","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":43},"status":"publish","excerpt":"Servicing over 11,000 clients across its 9 different companies, LBMC was seeking a more dynamic way to bring together client data to visualize more insights across their firm\u2019s diverse business practices to grow and strengthen their client relationships."},{"id":39896,"link":"https:\/\/www.introhive.com\/resource\/osler\/","name":"osler","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2021\/07\/osler-feature-image.png","alt":"osler"},"title":"Osler: Elevate Client Experience via Relationship Intel","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 24, 2024","dateGMT":"2024-07-24 07:43:09","modifiedDate":"2025-01-14 11:50:12","modifiedDateGMT":"2025-01-14 16:50:12","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":44},"status":"publish","excerpt":"How Introhive helped Osler, Hoskin & Harcourt LLP offer a collaborative \u201cone \ufb01rm\u201d approach in offices in Toronto, Montr\u00e9al, Calgary, Ottawa, Vancouver, and New York, providing responsive, proactive, and practical legal solutions on an array of domestic and cross-border legal issues."},{"id":39894,"link":"https:\/\/www.introhive.com\/resource\/lupton-fawcett\/","name":"lupton-fawcett","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2022\/04\/22.png","alt":"Lupton Fawcett Logo"},"title":"Lupton Fawcett: 350% ROI via Relationship Intelligence","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 24, 2024","dateGMT":"2024-07-24 06:56:40","modifiedDate":"2024-08-14 11:21:00","modifiedDateGMT":"2024-08-14 15:21:00","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":35},"status":"publish","excerpt":"Lupton Fawcett is a commercial law firm with offices in Leeds, Sheffield and York. Given its dedication to surpassing expectations, Lupton Fawcett has created a diverse team of 280+ passionate experts with a refreshing take on the full spectrum of commercial and personal legal services."},{"id":39891,"link":"https:\/\/www.introhive.com\/resource\/kaufman-rossin\/","name":"kaufman-rossin","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2022\/04\/23.png","alt":"Kaufman Rossin Logo"},"title":"Kaufman Rossin: Boost CRM Value & Automate Revenue Activities","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 24, 2024","dateGMT":"2024-07-24 06:17:49","modifiedDate":"2025-01-14 11:50:21","modifiedDateGMT":"2025-01-14 16:50:21","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":39},"status":"publish","excerpt":"A long-time proponent of innovation, Kaufman Rossin initially turned to Introhive for help boosting their lagging CRM adoption. Then they discovered the raw power of easy access to their own, high-quality relationship data to drive revenue."},{"id":39874,"link":"https:\/\/www.introhive.com\/resource\/howard-kennedy\/","name":"howard-kennedy","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2022\/04\/24.png","alt":"Howard Kennedy Logo"},"title":"Howard Kennedy: 400% Database Growth & CRM Adoption","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Jul 23, 2024","dateGMT":"2024-07-23 12:42:15","modifiedDate":"2025-01-14 11:50:32","modifiedDateGMT":"2025-01-14 16:50:32","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/case-studies\/' rel='resource-type'>Case Studies<\/a>"},"readTime":{"min":0,"sec":39},"status":"publish","excerpt":"As one of London\u2019s top law firms, Howard Kennedy LLP has over 200 lawyers that specialize in real estate, dispute resolution, private client and corporate law. Howard Kennedy prides itself on offering approachable, responsive, and exceptional legal services to every client, both domestic and international."}]

[{"id":46748,"link":"https:\/\/www.introhive.com\/resource\/strategic-account-management-framework\/","name":"strategic-account-management-framework","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/06\/Built-Environment-Guide-Cover-Image.jpg","alt":"Scaling Global Strategic Accounts with Introhive Cover image"},"title":"Scaling Global Strategic Accounts with Introhive: Solving Relationship Data Challenges for CRE and AEC Firms","author":{"name":"Galen Clark","link":"https:\/\/www.introhive.com\/author\/galen-clarkintrohive-com\/"},"date":"Jun 25, 2025","dateGMT":"2025-06-25 20:53:08","modifiedDate":"2025-06-25 16:53:09","modifiedDateGMT":"2025-06-25 20:53:09","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":6,"sec":8},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":46666,"link":"https:\/\/www.introhive.com\/resource\/introhive-ma-post-merger-integration\/","name":"introhive-ma-post-merger-integration","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/06\/The-Value-of-Introhive-for-MA-Guide-Cover-Image.jpg","alt":"The Value of Introhive for M&A Guide Resource Page Cover Image"},"title":"Introhive During M&A: Driving Growth Before & After the Deal","author":{"name":"Galen Clark","link":"https:\/\/www.introhive.com\/author\/galen-clarkintrohive-com\/"},"date":"Jun 10, 2025","dateGMT":"2025-06-10 13:09:56","modifiedDate":"2025-06-17 15:15:09","modifiedDateGMT":"2025-06-17 19:15:09","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":6,"sec":15},"status":"publish","excerpt":"In any merger, the biggest risks often hide in disconnected data and lost relationships."},{"id":46381,"link":"https:\/\/www.introhive.com\/resource\/accounting-solutions-playbook\/","name":"accounting-solutions-playbook","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/2025-Accounting-Guide-Cover-Image.jpg","alt":"2025-Accounting-Guide-Cover-Image"},"title":"Rewriting the Accounting Playbook","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"May 21, 2025","dateGMT":"2025-05-21 14:36:24","modifiedDate":"2025-05-26 15:22:31","modifiedDateGMT":"2025-05-26 19:22:31","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":5,"sec":41},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":46087,"link":"https:\/\/www.introhive.com\/resource\/contact-management-software-guide-introhive\/","name":"contact-management-software-guide-introhive","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/05\/The-Value-of-Introhive-Pre-CRM-Guide-Cover-Image-1.jpg","alt":""},"title":"The Value of Introhive Before You\u2019re Ready for a CRM","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"May 7, 2025","dateGMT":"2025-05-07 13:10:45","modifiedDate":"2025-05-26 14:33:29","modifiedDateGMT":"2025-05-26 18:33:29","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":6,"sec":20},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":45680,"link":"https:\/\/www.introhive.com\/resource\/digital-transformation-in-professional-services-firms\/","name":"digital-transformation-in-professional-services-firms","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2025\/03\/Data-Transformation-Guide-Cover-Image-5.jpg","alt":"Digital Transformation in Professional Services: A Guide"},"title":"Unlocking Digital Transformation ROI: Why Underlying Data is the Key","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"Mar 19, 2025","dateGMT":"2025-03-19 13:02:12","modifiedDate":"2025-05-26 14:53:33","modifiedDateGMT":"2025-05-26 18:53:33","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":5,"sec":51},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":43078,"link":"https:\/\/www.introhive.com\/resource\/ai-powered-crm-buyers-guide\/","name":"ai-powered-crm-buyers-guide","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/11\/AI-Buyers-Guide-Cover-Image-2.jpg","alt":"Maximizing Revenue and Amplifying Lead Generation: How to Choose the Right AI Solution"},"title":"Maximizing Revenue and Amplifying Lead Generation: How to Choose the Right AI Solution","author":{"name":"Lauren Howlett","link":"https:\/\/www.introhive.com\/author\/lauren-howlettintrohive-com\/"},"date":"Nov 14, 2024","dateGMT":"2024-11-14 11:00:18","modifiedDate":"2025-05-26 14:55:27","modifiedDateGMT":"2025-05-26 18:55:27","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":5,"sec":29},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":39971,"link":"https:\/\/www.introhive.com\/resource\/consulting-industry-trends-guide\/","name":"consulting-industry-trends-guide","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/10\/Consulting-Industry-Trends-Guide.jpg","alt":"The Future of Consulting: Industry Trends, AI Integration, and Client Intelligence"},"title":"The Future of Consulting: Industry Trends, AI Integration, and Client Intelligence","author":{"name":"cwalsh@pixelperfectdesignstudio.com","link":"https:\/\/www.introhive.com\/author\/cwalshpixelperfectdesignstudio-com\/"},"date":"Oct 10, 2024","dateGMT":"2024-10-10 12:56:25","modifiedDate":"2025-05-26 15:00:47","modifiedDateGMT":"2025-05-26 19:00:47","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a>"},"readTime":{"min":6,"sec":35},"status":"publish","excerpt":"In 2021, the worldwide management consulting market size exceeded $200 billion and experienced a healthy growth rate estimate of 12%. Despite the entire business community still dealing with the uncertainty brought on by the global pandemic, management consulting firms still moved forward."},{"id":40948,"link":"https:\/\/www.introhive.com\/resource\/ma-guide\/","name":"ma-guide","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/09\/MAGuide-Cover-Image.jpg","alt":"Maximizing Success in Mergers and Acquisitions: A Guide"},"title":"Maximizing Success in Mergers and Acquisitions: A Guide","author":{"name":"chisa.endo@introhive.com","link":"https:\/\/www.introhive.com\/author\/chisa-endointrohive-com\/"},"date":"Sep 18, 2024","dateGMT":"2024-09-18 21:25:36","modifiedDate":"2025-05-26 15:05:33","modifiedDateGMT":"2025-05-26 19:05:33","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a><a href='https:\/\/www.introhive.com\/resources\/type\/whitepaper\/' rel='resource-type'>Whitepaper<\/a>"},"readTime":{"min":5,"sec":58},"status":"publish","excerpt":"You don\u2019t have time to focus on both manual data entry and the art of selling. So, what is there to do about it?"},{"id":39994,"link":"https:\/\/www.introhive.com\/resource\/the-forrester-total-economic-impact-study\/","name":"the-forrester-total-economic-impact-study","thumbnail":{"url":"https:\/\/www.introhive.com\/wp-content\/uploads\/2024\/08\/Resource-Featured-images.jpg","alt":"The Forrester Total Economic Impact\u2122 Study for Introhive\u2019s Customer Intelligence Platform"},"title":"The Forrester Total Economic Impact\u2122 Study for Introhive\u2019s Customer Intelligence Platform","author":{"name":"Angela Ferreira","link":"https:\/\/www.introhive.com\/author\/angela-ferreiraintrohive-com\/"},"date":"Aug 2, 2024","dateGMT":"2024-08-02 12:36:25","modifiedDate":"2025-05-28 10:32:38","modifiedDateGMT":"2025-05-28 14:32:38","commentCount":"0","commentStatus":"closed","categories":{"coma":"","space":""},"taxonomies":{"resource-type":"<a href='https:\/\/www.introhive.com\/resources\/type\/guides\/' rel='resource-type'>Guides<\/a>"},"readTime":{"min":3,"sec":39},"status":"publish","excerpt":"Read this commissioned study conducted by Forrester Consulting to learn how Introhive helps improve Marketing Business Development efficiency and effectiveness while delivering a 495% ROI."}]