Introhive for

Accounting Firms

Introhive helps your firm identify cross-sell opportunities so teams can focus on expanding your most valuable relationships, not updating CRM.

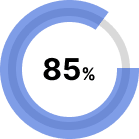

Top 20

Introhive works with 85% of the top 20 Accounting firms

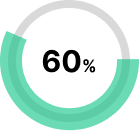

Top 50

Introhive works with 60% of the top 50 Accounting firms

Trusted by the world’s leading Accounting firms

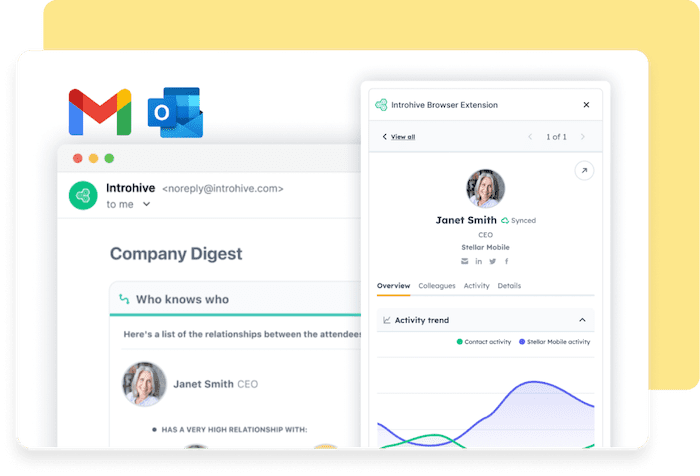

Growth starts with visibility

So that your teams spend less time updating records and more time building business with your most important clients.

Expand relationships with current clients

Introhive helps uncover cross-sell opportunities within existing accounts by showing where clients already have strong relationships and where they don’t.

Whether it’s expanding an audit relationship into advisory or identifying tax clients who could benefit from consulting, your teams get clear visibility to grow accounts with the services you already offer.

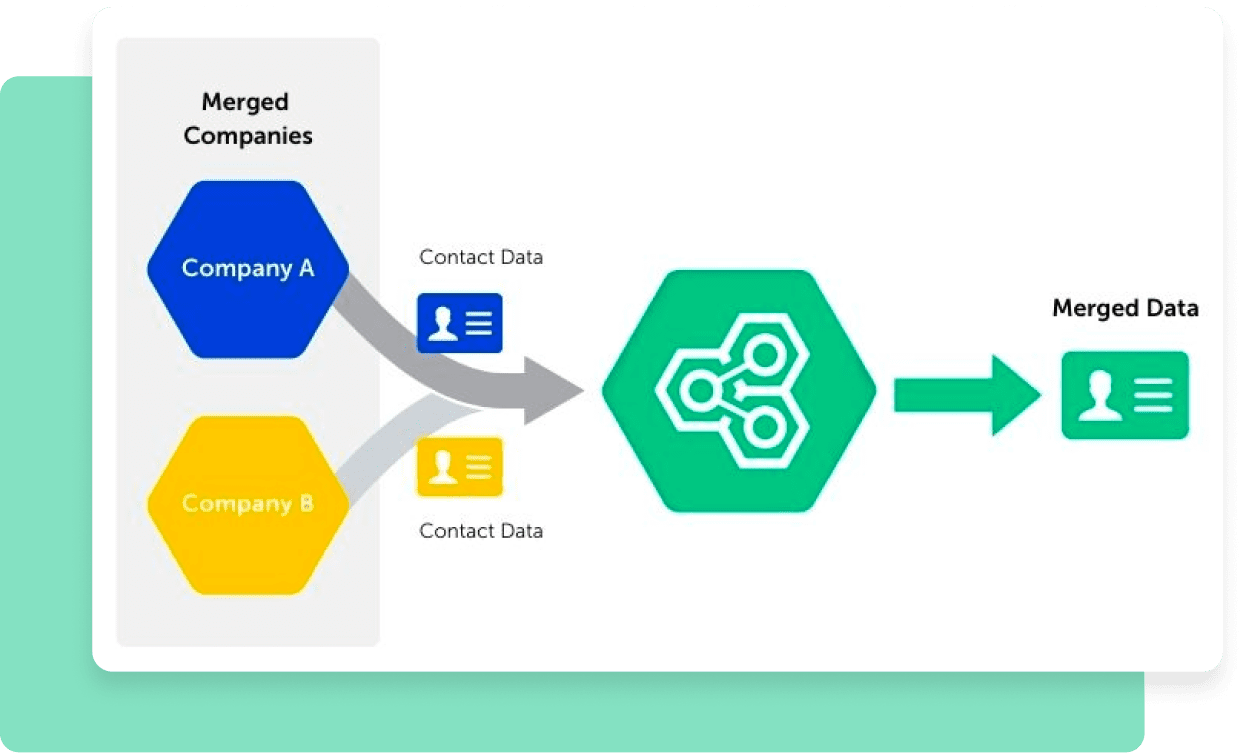

Streamline mergers & acquisitions

Introhive gives you a clear, actionable view of relationship strength so you can prioritize big accounts, sell more, and win faster.

Testimonials

Our firm loves the transparency Introhive provides our professionals into “who knows who” relationship insights. Right after go live, our firm was able to win a new deal valued at $250,000 thanks to the Introhive platform.

National Marketing Director – Account Management, CRM and Field Marketing

Erin M. Connolly-Kriarakis

Implementing Introhive was one of the simplest we’ve come across in terms of implementations, very straightforward, both from a technical perspective but also from a training and the results are that our adoption rates are great.

Chief Digital Officer

Rob Talson

Introhive is a tool that adds instant value to our end-user professionals in the form of time savings, but it also contributes to the bigger objective of our firm, which is gathering a holistic view of client intelligence in a centralized repository.

Chief Marketing Officer

Suzanne Reed

Our awards

FREE GUIDE

Accounting solutions, CPA firm of the future